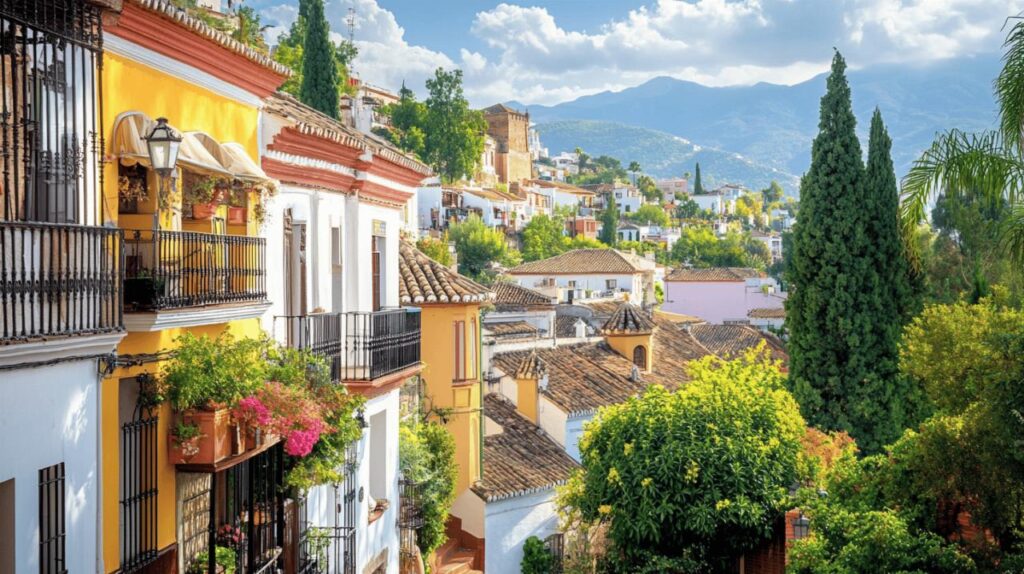

Spain continues to captivate international investors with its unique blend of sunshine, cultural richness, and diverse property opportunities. Whether you’re looking for a holiday home, rental income, or long-term capital growth, the Spanish real estate market offers compelling possibilities for both seasoned and first-time investors. This comprehensive guide examines the current landscape and essential considerations for those considering property investment in this vibrant Mediterranean country.

The spanish property market overview

Spain’s property market has demonstrated remarkable resilience and growth in recent years, establishing itself as one of Europe’s most attractive investment destinations. According to recent data, major urban centers like Madrid and Barcelona have recorded impressive value increases of 6.3% and 5.7% respectively in 2024 alone. What makes Spain particularly appealing is its affordability compared to other Western European nations. While the average price per square metre in Spain hovers around €1,734, comparable properties in France and the UK command significantly higher prices at €4,095 and €5,723 respectively, based on Q4 2024 figures. For investors seeking information about specific regions, resources like canaryislandspropertyworld.es provide specialized insights into island property markets and investment trends.

Current market trends and statistics

The Spanish property landscape presents a diverse range of investment opportunities across different price points. Entry-level apartments in popular coastal areas start from approximately €200,000, while luxury villas in prestigious locations like Marbella can reach €10,000,000 or more. For those interested in new developments, projects such as ZEW Elviria starting from €700,000 and The Kove from €370,000 represent the spectrum of available options. The rental market also presents compelling potential, with long-term rental yields in major Spanish cities averaging between 4% and 6%, making this an attractive proposition for income-focused investors. Mortgage conditions remain favorable despite recent global economic challenges, with fixed-rate interest rates stabilizing around 3.25%–3.75% according to Bank of Spain data from Q1 2025.

Regional variations across Spain

Investment opportunities vary significantly across Spain’s diverse regions, each offering unique advantages. The Costa del Sol continues to attract premium investment with its established infrastructure and international appeal. Properties in East and West Marbella command premium prices due to their exclusivity and world-class amenities. The Balearic Islands, particularly Ibiza, attract luxury buyers seeking privacy and prestige. Meanwhile, the Canary Islands, especially Tenerife, offer year-round sunshine and a growing property market that appeals to both holiday home buyers and rental investors. Beyond these coastal hotspots, major cities like Barcelona and Madrid appeal to urban investors, while regions such as Valencia and Alicante offer a compelling blend of lifestyle benefits and more moderate property prices. This regional diversity allows investors to tailor their strategy to specific goals, whether focused on rental income, capital appreciation, or lifestyle benefits.

Legal framework for foreign investors

Spain maintains an open policy toward foreign investment in real estate, with no significant restrictions on property ownership by non-residents. This accessibility makes it particularly attractive for international buyers seeking European property assets. However, understanding the legal framework is essential for navigating the purchase process successfully and avoiding potential pitfalls. One notable change in recent legislation is the termination of the Golden Visa programme, which previously offered residency options for substantial property investments. Despite this change, Spain remains accessible to foreign investors from both EU and non-EU countries.

Spain maintains an open policy toward foreign investment in real estate, with no significant restrictions on property ownership by non-residents. This accessibility makes it particularly attractive for international buyers seeking European property assets. However, understanding the legal framework is essential for navigating the purchase process successfully and avoiding potential pitfalls. One notable change in recent legislation is the termination of the Golden Visa programme, which previously offered residency options for substantial property investments. Despite this change, Spain remains accessible to foreign investors from both EU and non-EU countries.

Purchase process and documentation requirements

The Spanish property purchase process follows a structured sequence that typically begins with property selection and proceeds through reservation, preliminary contract, and final deed signing. Non-EU citizens must obtain a foreigner identification number known as NIE before purchasing property. This essential document, along with a Spanish bank account, forms part of the core requirements for completing a transaction. The conveyancing process typically takes between one and three months, depending on various factors including property type and financing arrangements. Working with qualified legal representatives is strongly recommended to navigate the complexities of Spanish property law and ensure all documentation meets requirements. Buyers should also conduct thorough due diligence, including property registry checks and verification of planning permissions, particularly for rural properties or those with recent modifications.

Tax implications for non-resident property owners

Spain imposes several taxes on property transactions and ownership that foreign investors must factor into their financial planning. At the purchase stage, buyers face Property Transfer Tax which varies by region with rates such as 10% in Catalonia for resale properties. For new builds, Value Added Tax applies instead, currently at 10%. Annual property ownership incurs local property tax known as IBI, typically between 0.4% and 1.1% of the cadastral value. Non-resident property owners must also file annual income tax declarations, even if the property generates no rental income, with a deemed rental value calculated for tax purposes. Rental income is taxed at 24% for non-EU residents and 19% for EU residents, with certain expenses deductible. When selling, capital gains tax applies at rates ranging from 19% to 26% depending on the gain amount. Professional tax advice is essential for optimizing the tax position and ensuring compliance with both Spanish and home country tax obligations.

The Spanish cost of living, reportedly up to 30% lower than major cities like London, Paris, or Amsterdam according to Numbeo 2025 data, further enhances the appeal of property investment in Spain. Combined with approximately 300 days of sunshine annually in many regions, these factors create a compelling case for both lifestyle and investment considerations. However, prospective investors should be mindful of potential challenges including language barriers, bureaucratic processes, and regional market variations. Developing relationships with local professionals, including real estate agents, legal advisors, and property managers, can significantly mitigate these challenges and enhance investment outcomes in this dynamic and rewarding market.